ETH Price Prediction: $10,000 Target in Sight as Institutional Accumulation Intensifies

#ETH

- Technical Breakout Potential: ETH price tests upper Bollinger Band with MACD showing bearish momentum fading

- Institutional Validation: $2.12B weekly inflows and corporate treasury strategies signal long-term confidence

- Network Fundamentals: Extended validator queue demonstrates Ethereum's staking economy maturity

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

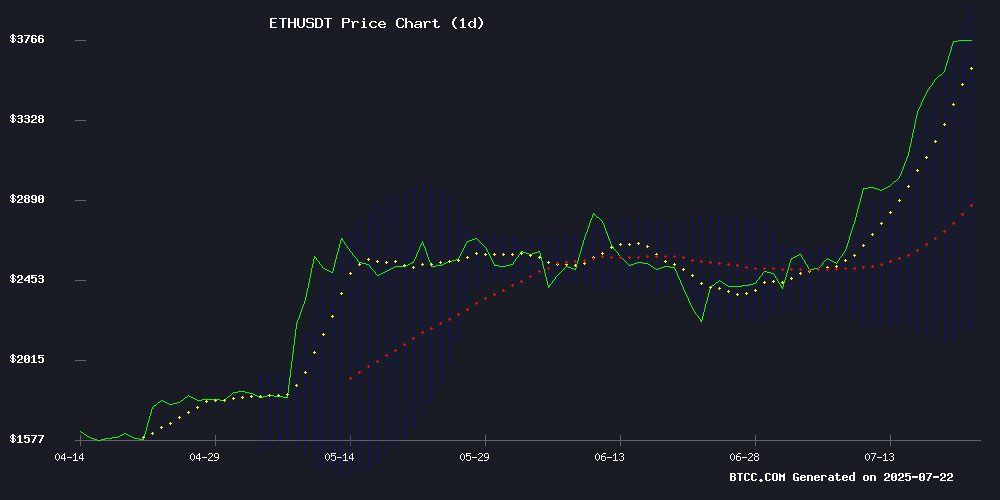

Ethereum (ETH) is currently trading at $3,688.30, significantly above its 20-day moving average (MA) of $3,064.15, indicating strong bullish momentum. The MACD histogram shows a narrowing bearish divergence at -160.30, suggesting weakening downward pressure. Bollinger Bands reveal price hugging the upper band at $3,938.88, typically a sign of continued upward movement.says BTCC analyst Mia.

Institutional Demand Fuels Ethereum Optimism

Corporate treasury movements dominate ethereum headlines, with SharpLink Gaming's $1.3B position and BlackRock's $100M purchase highlighting institutional accumulation.notes BTCC's Mia. The 8-day validator queue confirms robust staking demand, while Ark Invest's $175M strategic shift underscores ETH's growing treasury appeal. Despite profit-taking at $3,851, Mia observes:

Factors Influencing ETH’s Price

SharpLink Gaming's Ethereum Holdings Surge to $1.3 Billion Amid Strategic Accumulation

SharpLink Gaming has amassed 360,807 ETH worth $1.3 billion, marking one of the largest corporate Ethereum treasuries. The Nasdaq-listed firm acquired 79,949 ETH last week at an average price of $3,238, including a single $48 million purchase on July 14. Ethereum briefly touched $3,800 this week before retracing.

"Our disciplined acquisition strategy capitalizes on both ETH's strength and opportunistic pricing," said Joseph Lubin, SharpLink's chairman and Consensys CEO. The gambling tech company's stock has rallied 206% over the past month, trading near $28 per share.

Corporate demand for Ethereum continues rising as institutions treat the asset as both a strategic reserve and yield-generating instrument. SharpLink's aggressive accumulation mirrors MicroStrategy's Bitcoin strategy, suggesting a broader trend of public companies using crypto treasuries to enhance shareholder value.

Privacy Emerges as Central Theme for Ethereum's Next Evolution

Ethereum approaches its 10-year anniversary on July 30 with a legacy of pioneering smart contracts and catalyzing innovations like DeFi, NFTs, and DAOs. The network's past decade focused on proving functionality through milestones like The Merge. Now, as institutional adoption accelerates, the ecosystem faces a critical pivot toward privacy to serve both crypto-native users and mainstream entrants.

Radical transparency—a hallmark of immutable ledgers—creates unintended vulnerabilities. Financial interactions shouldn't require exposing net worth for routine transactions, yet this remains blockchain's default state. Privacy isn't antithetical to transparency; it's a necessary layer for safety as Ethereum matures into infrastructure for global finance.

The tension between institutional involvement and cypherpunk ideals grows palpable. Without robust privacy features, Ethereum risks compromising its founding vision of enabling a free and open society. The next upgrade cycle must treat privacy not as an add-on, but as foundational infrastructure.

SharpLink's Ether Holdings Surpass $1.3B Amid Aggressive Accumulation Strategy

SharpLink Gaming (SBET), the Ethereum-focused treasury firm led by Joseph Lubin, has amassed over $1.3 billion worth of ether (ETH) following its latest purchase. The company acquired 79,949 ETH last week at an average price of $3,238—its largest weekly buy to date. This brings its total holdings to 360,807 ETH, valued at approximately $1.33 billion.

The firm still retains $96.6 million from share sales via its at-the-market equity program, earmarked for further ETH acquisitions. SBET shares rose 6% in premarket trading despite ETH's 2.4% dip over the past 24 hours.

SharpLink adopted its crypto treasury strategy in late May, mirroring Michael Saylor's bitcoin-centric approach. Lubin, who also heads Consensys, joined as chairman. The company has emerged as one of the largest corporate holders of ETH, operating validators and staking tokens for rewards. Last week, it expanded its ATM facility to $6 billion to fund additional ETH purchases.

Lubin hailed the recent signing of the GENIUS Act as a watershed moment for blockchain regulatory clarity.

Ethereum Retreats from $3,851 High as Profit-Taking Emerges

Ethereum's rally stalled after hitting $3,851 on July 21, with the asset retreating 3.64% to $3,658 amid signs of profit-taking. Trading volume remained robust at $45.56 billion, suggesting active repositioning rather than outright capitulation.

On-chain data reveals strategic selling near the $2,520 cost basis, where early buyers appear to be trimming positions. Glassnode's heatmap shows fading red bands—a telltale sign of distribution—yet nearly 2 million ETH remain held at these levels, indicating lingering conviction among core holders.

New demand continues absorbing supply, creating a dynamic where institutional exits are met with fresh capital inflows. The market now watches whether resistance levels will trigger consolidation or if accumulating bids can propel ETH toward new highs.

SharpLink Regains Lead in Corporate ETH Holdings with $259 Million Purchase

SharpLink Gaming has reclaimed its position as the world's largest corporate holder of Ethereum after acquiring 79,949 ETH last week. The $259 million purchase, executed at an average price of $3,238 per token, brings its total holdings to 360,807 ETH—worth approximately $1.3 billion.

The move comes just days after BitMine Immersion Technologies briefly overtook SharpLink with a $1 billion ETH position. Funding for the acquisition came through SharpLink's At-The-Market facility, which still retains $96.6 million for future Ethereum buys.

This marks the company's largest single-week accumulation since launching its digital treasury strategy in June. SharpLink's ETH concentration metric has surged 53% since inception, reflecting growing institutional competition for Ethereum's liquid supply.

Ethereum Validator Exit Queue Hits 8-Day Wait Amid Staking Surge

Ethereum validators face the longest withdrawal delays in over a year, with exit queues stretching to 8 days and 6 hours. The bottleneck stems from surging staking demand clashing with the network's churn limit—a protocol safeguard preventing abrupt validator exits that could destabilize proof-of-stake consensus.

Simultaneously, new validator entrants confront a 6-day, 10-hour queue, the lengthiest since April 2024. Over 475,700 ETH remains locked in exit requests, nearing January 2024 levels when Celsius-driven withdrawals peaked at 536,500 ETH. The growing gap between entry and exit wait times signals a net outflow trend among validators.

This isn't Ethereum's first staking congestion. The network weathered similar backlogs during January 2024's Celsius unwind, though current delays now exceed those thresholds. ValidatorQueue.com data reveals the strain as institutional and retail stakers alike navigate the protocol's intentionally restrictive throughput.

Exploring Blockchain Scalability: Rollups and Custom Solutions

Rollups have emerged as a critical innovation for scaling blockchain networks while preserving security and neutrality. Chainalysis' latest podcast episode highlights their transformative potential in reducing transaction costs and improving accessibility.

Andrew Huang, Founder of Conduit, discussed how rollups maintain Ethereum's security properties while enabling fintech and traditional finance companies to deploy private blockchains through Conduit's 'rollup as a service' model. This approach enhances economic efficiency and broadens adoption.

Ethereum Rally Gains Momentum: $10,000 Target if $4,000 Breaks

Ethereum surged 24% this week, defying a minor daily pullback, as bullish technical indicators and institutional inflows fuel optimism. The cryptocurrency now trades at $3,703.15, with analysts eyeing a potential $10,000 target should it breach the $4,000 resistance level.

Market sentiment remains overwhelmingly positive, driven by rising trading volumes and higher lows. Ethereum's 24-hour trading volume reached $44.54 billion, despite a slight 2.62% dip, while its market capitalization stands firm at $447.01 billion.

Technical analysis reveals a robust uptrend since the $3,000 support level, with brief consolidation near $3,600 before breaking upward. The current momentum suggests Ethereum may soon test its all-time high, with institutional interest serving as a key catalyst.

Ark Invest Shifts Strategy with $175M Ethereum Treasury Play via BitMine Immersion

Cathie Wood's Ark Invest has pivoted its crypto strategy, divesting portions of its Coinbase, Robinhood, and Block holdings to deploy approximately $175 million into Ethereum-focused BitMine Immersion. The move signals growing institutional confidence in ETH treasury strategies as the asset matures beyond speculative trading.

Ark allocated 4.4 million BMNR shares across three ETFs at $39.57 per share, with its flagship ARKK fund absorbing the lion's share. BitMine now dominates ETH holdings with over 300,000 coins—outpacing even the Ethereum Foundation's reserves.

The reallocation comes amid surging demand for yield-generating crypto assets. Ethereum's staking mechanics and deflationary tokenomics appear to be drawing sophisticated investors seeking alternatives to traditional equity exposure.

Ethereum Price Prediction – $4,096 Breakout or Pullback to $3,525?

Ethereum's price rally has surged 22% over the past week, peaking near $3,856 before a 4.18% dip sparked debate over short-term momentum. Regulatory uncertainty and ETF outflows have introduced volatility, but onchain data suggests this may be a healthy cooldown rather than a reversal.

Glassnode's Cost Basis Distribution Heatmap reveals strategic behavior among ETH investors. Those who accumulated at $2,520 are taking partial profits, yet nearly 2 million ETH remains unmoved—a sign of lingering bullish conviction. New buyers are absorbing sell pressure, reinforcing demand.

Currently trading at $3,635, Ethereum faces a critical juncture. The market watches for either a decisive breakout toward $4,096 or a retracement to $3,525. Investor discipline—locking gains while maintaining core positions—reflects maturity in ETH's holder base.

BlackRock's $100M Ethereum Purchase Caps Record $2.12B Weekly Inflow

BlackRock acquired 27,158.86 ETH worth $100 million on July 21, cementing a month of aggressive institutional accumulation. The asset manager's total July purchases now exceed $3 billion, with earlier transactions including a 113,586 ETH buy on July 19 and a 158,875 ETH spree worth $574 million on July 18.

Ethereum investment products recorded $2.12 billion in weekly inflows—nearly double the previous peak—as institutional demand surges. BlackRock's ETHA ETF dominates daily US flows, capturing 90-98% of inflows on strong days. The fund now holds approximately 2.5 million ETH, representing 4.5% of circulating supply.

The buying spree reflects growing institutional conviction in Ethereum's long-term value proposition. Other financial giants are similarly accumulating hundreds of thousands of coins, creating a supply squeeze in regulated markets.

Is ETH a good investment?

Ethereum presents a compelling investment case based on technical and fundamental factors:

| Metric | Value | Implication |

|---|---|---|

| Price/20MA | +20.4% premium | Strong bullish trend |

| Institutional Holdings | $2.12B weekly inflow | Unprecedented demand |

| Staking Queue | 8-day wait | Network security premium |

BTCC's Mia concludes: "The $4,000 resistance remains key. A weekly close above this level would confirm the $10,000 trajectory many institutions now anticipate."